La stagione della caccia (aprile 2022)

Oggi si apre la stagione delle trimestrali: il periodo nel quale le Società quotate in Borsa hanno l’obbligo di riferire al pubblico sui propri risultati del trimestre che si è appena concluso.

Negli ultimi anni, tutti noi investitori siamo stati abituati a dare per scontato che dalla stagione delle trimestrali uscissero solo buone notizie: questo perché abbiamo tutti vissuto, operato ed investito in un contesto artificiale ed artefatto.

La grande utilità della stagione delle trimestrali, al contrario, deriva proprio dal fatto che NON TUTTO va come si prevede: ci sono buone notizie, anche migliori del previsto, ma pure cattive notizie.

Soltanto così, un investitore capace di investire distingue il buono dal cattivo investimento.

Per qualche anni, i mercati sono stati calati in una situazione artificiale ed artefatta del “tutto è buono”, ma quella stagione è finita, per fortuna.

Per fortuna è finita, e quindi anche la stagione delle trimestrali torna ad occupare il suo ruolo centrale. Ed ecco che Recce’d, prontissima, dopo avere fornito ai propri Clienti nel The Morning brief per ben tre settimane tutte le notizie, i dati e le anticipazioni necessarie, adesso attraverso questo Post regala anche al pubblico dei propri lettori un contributo di informazione selezionata: così che i dati, che comincerete a leggere da oggi, vi risulteranno più chiari, e la reazione del mercato vi risulterà comprensibile.

Che cosa vi serve, per comprendere quello che succede sui mercati, e quindi anche ai vostri soldi?

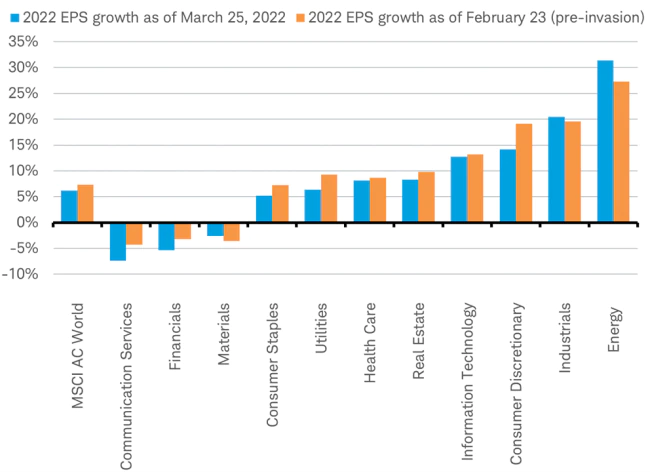

I dati delle immagini di questo Post, ad esempio.

E poi un po’ di semplice matematica, che trovate qui sotto sia nel testo sia nell’immagine. Non vi resta di farveli da soli, due conti, e poi continuare a leggere più in basso.

While we often search for reasons for why the stock market is dropping, sometimes it’s simple math. The yield on the benchmark 10-year U.S. Treasury yield has risen 0.038 percentage point to 2.753% on Monday, and higher bond yields put pressure on valuations by reducing the “equity risk premium,” or the amount of extra return an investor should expect to get from stocks.

The math works like this. The S&P 500 had a price/earnings ratio of 19.35 at Friday’s close. Flip the P/E to get the E/P, or earnings yield, in this case, 5.17%, subtract the 2.75% 10-year yield, and you get an equity risk premium of 2.4%. Now, compare that to the start of the year, when the 10-year traded at 1.5%, and stocks traded at 21.5 times earnings, or an earnings yield of 4.65%. That meant stocks, even at a higher valuation, offered 3.15% more than a Treasury, meaning that investors earned a higher risk premium, despite the S&P 500’s higher P/E at the time.

All of this, of course, is due to the Federal Reserve, which is expected to aggressively hike interest rates this year and next as it battles historically high inflation. It may also be planning to begin “quantitative tightening,” or reducing its balance sheet, as early as its May meeting. Last week, comments from a number of officials at the central bank and the minutes from the last Fed meeting suggested the Fed will move aggressively to tighten policy, with a sizable half-point rate hike expected soon.

“Last week’s unexpectedly aggressive pivot by several Fed officials, who are normally considered to be of a more dovish persuasion, [has seen] U.S. 10-year, 5-year, and 2-year yields hit their highest levels in over three years,” said Michael Hewson, an analyst at broker CMC Markets.

In the spotlight this week will be a key U.S. inflation reading. The release Tuesday of the consumer-price index for March will be the last CPI data the Fed receives before its next meeting on monetary policy.

Also in focus is the start of the first-quarter earnings season. While just 15 companies in the S&P 500 will report results, they include major U.S. financial groups JPMorgan Chase (ticker: JPM) and BlackRock (BLK) on Wednesday, before Citigroup (C), Morgan Stanley (MS), Goldman Sachs (GS), and Wells Fargo (WFG) on Thursday.

Detto qui sopra dei multipli e delle valutazioni, passiamo ora a tratare dei temi principali di questa stagione delle trimestrali: ve li abbiamo, per vostra comodità, evidenziati nel brano che segue.

The good news is that corporate sales are forecast to grow briskly in the first quarter, up from expectations earlier this year.

The bad news is that corporate profits are expected to grow about half as fast as sales. This margin compression doesn’t bode well for stock prices during earnings season, particularly since the market has run up in recent weeks.

The earnings should show an economy that continues to steam along, despite rampant inflation and war in Ukraine. Analysts expect first-quarter sales for S&P 500 companies, in aggregate, to have grown 10.7% year-over-year, up from 9.7% expected growth at the start of the year, according to FactSet. The increased revenue estimates come even as the Russian invasion of Ukraine—and Western sanctions on Russian energy—have boosted commodity prices. On top of that, the Federal Reserve has already begun lifting interest rates to curb economic demand and high inflation. Earnings per share on the S&P 500, are expected to rise 4.8% year-over-year, down from 5.7% expected growth at the beginning of the year.

When sales growth is faster than profit growth, it means companies’ costs are rising faster than sales and their profit margins are declining. For some companies, higher commodity costs are hurting margins. Others are getting hurt by shortages of steel and other metals. And companies of all stripes are paying higher wages to workers. “We are seeing a real margin headwind for the average company,” says Christopher Harvey, chief U.S. equity strategist at Wells Fargo.

The falling profit margins are particularly noticeable in the industrials sector. Caterpillar (CAT), is expected to see its operating margin fall to 13.4% in the first quarter from 15.3% in the first quarter last year. Even Deere & Co. (DE), which is usually able to lift prices of its farm equipment substantially when its costs rise, is expected to see its operating margin decline to 20.9% from 22% in the same quarter last year. 3M (MMM) is expected to see its operating margin fall to 20% from 22.5% last year. Indeed, the industrial sector has experienced the largest year-to-date decline in first-quarter earnings estimates out of any S&P 500 sector, according to FactSet.

Meanwhile, the broader stock market, hit hard earlier this year, has been rebounding in recent weeks. The S&P 500 is up about 7% from its closing low of the year, struck on March 8. A more frothy market only makes future gains harder to come by.

So with stocks getting more expensive, it’s less likely that they will post big gains after reporting earnings. The S&P 500’s aggregate forward earrings multiple is now about 19.3 times, up from a low of just under 18 times last month. Stock prices are now reflecting a large expected earnings stream in the future.

When stocks trade at such a lofty multiple, companies typically need to beat earnings estimates by a large percentage to send share prices moving up. “You’re setting up for an earnings season that needs to be good, both in terms of the numbers that come in and the forward guidance,” says Dave Donabedian, chief investment officer of CIBC Private Wealth US. “The bar is set high. It’s going to be tough to clear the bar.”

That doesn’t mean equity investors should give up hope on finding good buys during earnings season. Companies whose shares have already been pounded before releasing earnings could see their shares rise after releasing less-than-stellar results. They could be enticing buys at the right moment. “How has the company traded into earnings?” Harvey says. If a stock is down, it presents “a little bit of a better risk/reward because it’s priced in some of the bad news.”

Lulu Lemon Athletica (LULU) is a good example. The company posted a mixed quarter, missing sales expectations and beating EPS estimates. The stock gained almost 10% the trading day after it reported earnings in late March. It had fallen 12% for the year through the day before earnings.

It’s a tricky market. Finding beatdown names into earnings reports is one viable strategy.

Abbiamo chiarito, grazie al brano che avete appena letto, quali saranno i temi intorno ai quali si concentrerà l’attenzione di chi investe in Borsa, negli Stati Uniti come in Europa, nel prossimo mese e più. per completare questo lavoro che Recce’d vi offre, ci concentriamo sulla strettissima attualità: da oggi vedremo quali sono i risultati trimestrali delle grandi banche USA, e quindi abbiamo valutato opportuno selezionare per voi un’analisi di questo specifico settore, analisi che vi offriamo in lettura qui di seguito e che chiude il Post.

Subito all’apertura dell’articolo che segue, leggete il tema “caldo”: la ricaduta dell’aumento dei tassi di interesse sui conti delle banche. Con i nostri Clienti, ne abbiamo discusso in dettaglio nelle ultime due settimane. Loro, i nostri Clienti, non avranno sorprese. Per voi lettori del Blog, nell’articolo abbiamo evidenziato i temi ai quali prestare maggiore attenzione nelle prossime due settimane.

For years, bank investors wanted to see the Federal Reserve launch an aggressive series of interest-rate increases. They are finally getting their wish, but it is unlikely to be much help to the stocks in the near term.

The big banks’ earnings begin this week, with JPMorgan Chase (ticker: JPM) the first out of the gate on Wednesday. Analysts are at a bit of a loss over what exactly to expect from the sector in light of the Fed’s promises of bold moves against high inflation on one side, and the war in Ukraine on the other.

The Fed’s move to lift interest rates should be a boon for net interest income at the banks because that generally widens the gap between what they pay for funds and what they receive from loans. But the recent inversion of the yield curve, with yields on short-term debt above those on long-term securities, has Wall Street worrying about a recession, which obviously benefits no one.

One thing Wall Street can agree on is that earnings will be weaker than a year ago because the first quarter of 2021 was so strong. Capital markets and trading activity has been slower and investors can’t count on banks releasing billions of dollars of reserves—money set aside to cover pandemic-era loan losses that didn’t materialize—to boost returns. Across the industry, the team at S&P Global Markets Intelligence expects, earnings will fall by 8.4% despite the benefit of higher rates.

“The Federal Reserve’s efforts to combat inflation will boost banks’ net interest margins, but mountains of excess liquidity will prevent the key metric from returning to prepandemic levels in excess of 3.30% until 2026,” according to Nathan Stovall, principal analyst at S&P Global.

It’s a sentiment widely held on Wall Street. Analysts at Baird expect an unspectacular performance from the stocks as earnings roll in.

“Even with rates being higher in recent weeks, sentiment has become more negative, reflecting general macro fears and the group being crowded and consensus earlier this year. With the stocks being de-risked in recent days, we expect the group to trade OK as we move through reporting,” David George, analyst at Baird, wrote in a recent note.

Barron’s warned earlier this year that it was time to be choosy on the banks. While the sector looks safe, some banks are better equipped to navigate today’s challenges than others.

One area of particular concern is how much Russia’s invasion of Ukraine will weigh on the U.S. banks. So far, the direct impact appears to be quite minimal as many banks pulled back on their dealings with Russia in response to sanctions levied following Russia’s annexation of Crimea in 2014. But little exposure doesn’t equal zero exposure.

Goldman Sachs (GS) and JPMorgan recently said that they plan to exit Russia. JPMorgan noted that it could lose $1 billion due to its Russia exposure. Citigroup (C) has said that it stands to lose $4 billion. Goldman’s exposure to Russia is $700 million, according to the bank’s financial filings.

And then there are the knock-on effects of geopolitical concerns. While the banks themselves may not be directly exposed to the crisis, their clients may be feeling the pain more in terms of higher prices and other difficulties running their businesses. No doubt Wall Street will be paying close attention to this when CEOs give their views on the macroeconomic outlook.

In the first-quarter results themselves, analysts expect to see weakness in investment banking, particularly in equity capital markets. Data from Dealogic shows that revenue is down 75% year over year and 61% quarter over quarter. The volume of deals that have been announced year to date has fallen by nearly a third compared with a blockbuster 2021. Backlogs of transactions appear strong, but completing deals is taking longer due to a tougher regulatory climate.

Trading is also going to be a challenging spot. The first quarter certainly brought volatility but it isn’t clear if it benefited banks. Still, strength in currency and commodity trading should offset weakness in equities.

Here’s what Wall Street expects for the big banks, according to FactSet data:

JPMorgan: Earnings of $2.72 per share on $30.6 billion in revenue. Net income of $8.2 billion, down 42% from last year.

Citigroup: Earnings of $1.43 per share on $18.3 billion in revenue. Net income of $3.1 billion, down 59% from last year.

Goldman Sachs: Earnings of $8.95 per share on $12 billion in revenue. Net income of $3.3 billion, down 51% from last year.

Morgan Stanley (MS): Earnings of $1.76 per share on $14.4 billion in revenue. Net income of $3.1 billion down 21% from last year.

Wells Fargo (WFC): Earnings of $0.82 per share on $17.8 billion in revenue. Net income of $3.3 billion, down 30.6% from last year.

Bank of America (BAC): Earnings of $0.75 per share on $23.3 billion in revenue. Net income of $6.2 billion, down 17.7%.

With the smallest expected drop in profits, Bank of America, which reports next Monday, is emerging as the favorite on the Street, with 61% of analysts ranking it a Buy. The consensus price target implies upside of 28% for the stock. While analysts at Keefe, Bruyette & Woods have a Market Perform rating on the stock, they note it is the “safe play” for this quarter, due to fewer risks for its capital markets business and its positive sensitivity to higher rates.

As for the others, expect a bumpy ride.