Perché a noi importa di Peloton

Insieme con la vicenda dei tassi interbancari USA, l’attenzione della stampa e dei media internazionali nell’ultima settimana si è concentrata su un secondo tema: il fallimento di una serie di operazioni di quotazione alla Borsa di New York. Che la stampa internazionale etichetta IPO, initial public offerings.

In particolare, la stampa internazionale ha tratto spunto da due fatti recenti: il primo riguarda WeWork, il secondo riguarda Peloton.

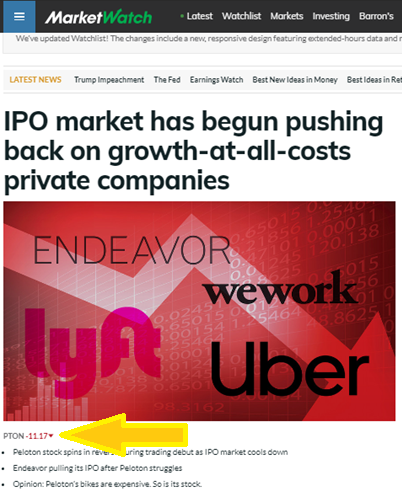

Di Peloton (un’azienda che produce macchinari per la palestra e l’esercizio fisico) ha colpito il calo del prezzo nello stesso giorno di apertura delle contrattazioni, superiore al 10%, come potete leggere sotto nell’immagine.

In questo Post, non ci occupiamo del perché e del percome le due operazioni (WeWork e Peloton) siano andate a finire male. Il grafico che segue, in estrema sintesi, è la risposta a questa domanda. Noi in questo Post utilizziamo lo spunto degli IPO per mettere in guardia gli investitori, ed in particolare gli investitori … in obbligazioni.

Si avete letto bene: il dramma si è svolto alla Borsa di New York, ma il comparto che potrebbe andare in tensione a causa di questa serie di fallimenti nelle operazioni di IPO è proprio quello obbligazionario. Vi offriamo alla lettura per questa ragione un brano che vi documenta lo stato degli affari oggi nel comparto dei junk bonds, le cosiddette obbligazioni spazzatura ovvero ad elevato rischio di credito, e delle operazioni di LBO, ovvero le operazioni finanziamento a rischio più elevato.

E’ molto interessante, per voi e per i vostri portafogli, prendere nota del fatto che, come spiega bene questo articolo, la situazione è del tutto capovolta rispetto a 12 mesi fa.

At a quick glance, everything seems wonderful in the world of risky credit. In September alone, companies have raked in more than $52 billion by tapping the U.S. leveraged-loan and high-yield bond markets.

But look a little closer and cracks start to emerge. Lots of cracks.

In recent weeks, a slew of companies -- typically those considered the riskiest of the risky -- have been forced to either ratchet up interest rates or dangle sweeteners to drum up investor demand and complete deals. A few more -- including at least four this month -- have been yanked from the market entirely.

One common refrain coming from investors is that they don’t want to touch companies with excessive debt, especially those from struggling sectors or with businesses that could suffer more in a downturn. Particularly problematic: companies rated B3 by Moody’s Investors Service or B- by S&P Global Ratings, one step away from the junk market’s riskiest tier.

“If you’re looking to finance an LBO in the wrong sector or a business vulnerable to a slowdown, that’s tougher,” said John Cokinos, co-head of leveraged finance at RBC Capital Markets. “The loan market has limited appetite for new B3 rated deals, and the high-yield market is pushing back on highly levered deals.”

LBO Pushback

The financing for Apollo Global Management’s buyout of Shutterfly has been a particular struggle. Pricing on the loan was increased twice, the size was cut and terms were sweetened. Major concessions have also been made in secured bonds that are part of the financing.

It’s just one example in a long list of difficult deals that have run up against a more risk-averse buyer base. Other LBO financings for Sotheby’s, Del Frisco’s and Vungle have had to make concessions, in some cases boosting interest rates to double digits.

Take Howden, a spinoff from Colfax to KPS Capital Partners. It hiked the yield on a junk bond to 11.75% amid worries about its exposure to coal and concerns from investors with environmental, social and governance mandates. Industry giant Peabody, meanwhile, withdrew a loan and then a junk bond after it faced pushback over headwinds in the sector. And steel manufacturer Stelco Holdings Inc. scrapped a $300 million bond, citing market conditions.

Howden’s isn’t the highest yield seen this month either. Australian steel and recycling company InfraBuild had to pay 12% on a five-year bond -- even after owner Sanjeev Gupta pledged to kick in $150 million of equity to appease prospective lenders.

The struggles have been masked by other positive market dynamics that paint a rosier picture. And pickiness of junk-debt buyers may offer a taste of what‘s in store for would-be borrowers headed into 2019’s final quarter.

Slowdown Concern

September was the busiest month of the year for leveraged-loan launches as well as for speculative-grade bond pricings. And yields on junk bonds reached the lowest in almost two years. That points to a risk-on market for investors looking for greater returns in a world with $15 trillion of negative-yielding debt.

But those days may be numbered with a slowdown weighing on investors’ minds.

“A recession isn’t imminent, but you need to have more robust growth to allow companies to grow into their capital structures,” said Greg Zappin, a money manager at Penn Mutual Asset Management, which oversees $27.6 billion.

The pushback on recent LBOs is a sharp contrast to a year ago, when multibillion-dollar buyout financings -- including those for Refinitiv and Envision Healthcare -- were flying off the shelf despite some of the worst investor protections ever seen. Since then, though, there’s been a clear shift toward quality.

“The whole talk that we’ve been in this credit cycle for so long isn’t new, but trade tensions have really had an impact, and there are parts of Europe now in recession,” Zappin said. “There’s also a U.S. election coming up,” he added. “People are just being more careful about what they want to own.”

Slapped Down

Loan investors enforced more controls on Apollo’s Shutterfly debt, including curbing the private equity firm’s ability to fund dividends and pay down a $300 million chunk of unsecured notes that it bought as part of the funding for its own LBO.

Read more: Apollo Buys $300 Million Bond Sale for Own Shutterfly LBO

Some of the loan financing was also shifted to bonds, a market that’s been a little more resilient. But even the bonds are offering one of the market’s biggest discounts in months.

Weak demand for the broader financing stems from the significant leverage being piled onto Shutterfly -- which will be merged with rival photo-sharing and printing company Snapfish -- and concern the business may be in a secular downtrend, according to some investors.