Come gestire nel 2018 (parte 5): sperare NON è una strategia

Il titolo è una notissima (ci hanno intitolato anche dei libri) frase fatta degli anglosassoni: "hope is not a strategy".

Sta di fatto che, nel 2018, le masse degli investitori hanno scelto di agire proprio in quel modo: "sperando" che da oggi in poi le cose vadano alla grande.

Certo, sono stati spinti, pressati, indottrinati. E' vero, va riconosciuto. E tuttavia ... così tanta "ingenuità" a noi sembra un caso da "psicologia delle masse".

Da anni, Recce'd sta qui a spiegare ai Clienti che "hope is not a strategy": anche solo per un istante, allontanare gli occhi dai dati di fatto, e farsi coinvolgere nella psicologia di massa, può essere un errore fatale.L'errore di una vita intera.

Se non ne siete convinti, rileggetevi questo brano: un brano che riportiamo in inglese per non modificare nulla. Non ci sono opinioni: solo un elenco di eventi storici e di dati di fatto, molto recenti, dai quali però (almeno fino ad oggi) le varie BCE, Fed, Goldman Sachs, Morgan Stanley, e la massa degli investitori sembrano non avere imparato nulla.

Recce'd vi invita non solo a riflettere: noi vi invitiamo, a investire, insieme a noi, in modo conseguente.

During the 40 months after Alan Greenspan's infamous "irrational exuberance" speech in December 1996, the NASDAQ 100 index rose from 830 to 4585 or by 450%. But the perma-bulls said not to worry: This time is different----it's a new age of technology miracles that will change the laws of finance forever.

It wasn't. The market cracked in April 2000 and did not stop plunging until the NASDAQ 100 index hit 815 in early October 2002. During those heart-stopping 30 months of free-fall, all the gains of the tech boom were wiped out in an 84% collapse of the index. Overall, the market value of household equities sank from $10.0 trillion to $4.8 trillion----a wipeout from which millions of baby boom households have never recovered.

Likewise, the second Greenspan housing and credit boom generated a similar round trip of bubble inflation and collapse. During the 57 months after the October 2002 bottom, the Russell 2000 (RUT) climbed the proverbial wall-of-worry----rising from 340 to 850 or by 2.5X.

And this time was also held to be different because, purportedly, the art of central banking had been perfected in what Bernanke was pleased to call the "Great Moderation". Taking the cue, Wall Street dubbed it the Goldilocks Economy----meaning a macroeconomic environment so stable, productive and balanced that it would never again be vulnerable to a recessionary contraction and the resulting plunge in corporate profits and stock prices.

Wrong again!

During the 20 months from the July 2007 peak to the March 2009 bottom, the RUT gave it all back. And we mean every bit of it----as the index bottomed 60% lower at 340. This time the value of household equities plunged by $6 trillion, and still millions more baby-boomers were carried out of the casino on their shields never to return.

Now has come the greatest central bank fueled bubble ever. During nine years of radical monetary experimentation under ZIRP and QE, the value of equities owned by US households exploded still higher----this time by $12.5 trillion. Yet this eruption, like the prior two, was not a reflection of main street growth and prosperity, but Wall Street speculation fostered by massive central bank liquidity and price-keeping operations.

Nevertheless, this time is, actually, very different. This time the central banks are out of dry powder and belatedly recognize that they have stranded themselves on or near the zero bound where they are saddled with massively bloated balance sheets.

(...)

In short, this time is truly different because the impending, spectacular late-cycle collision of US fiscal and monetary policies is sure to rock the $100 billion global bond market with severe, cascading ripples of downward pricing adjustments (i.e. higher yields and wider spreads). Yet the entire price structure of the equity market incorporates the previous era of drastically repressed yields.

In our judgment, a large share of the $15 trillion of US stock buybacks and M&A deals over the last decade would not have happened---save for the ultra-low after-tax cost of debt. For instance, mega-M&A deals by investment grade companies always look accretive to earnings because they have been 85% cash/debt financed at a weighted average after-tax cost of under 2.0%.

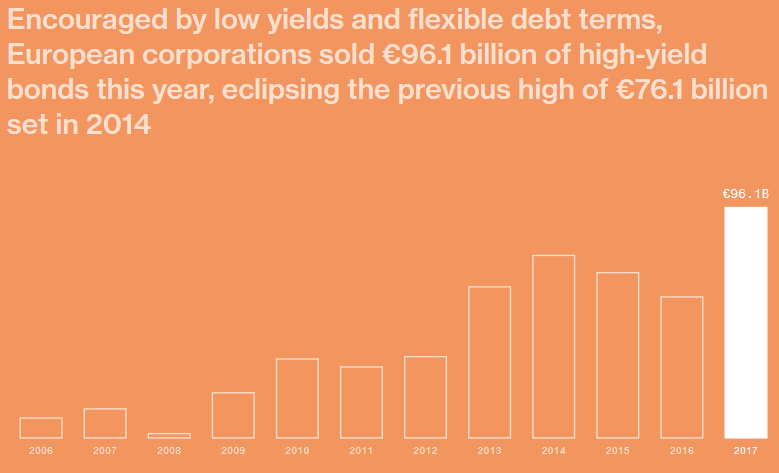

Likewise, the scramble for yield has funded a massive revival of the junk loan and bond markets---with combined outstandings now pushing $4 trillion or more than double the 2007 level. On the margin, virtually every dollar of that $2 trillion gain went into the liquidation of corporate equities via LBO's and leveraged recaps.

In a word, a huge chunk of the over-valuation in today's stock markets reflects the cheap debt fueled financial engineering "bid" for stocks that will be literally monkey-hammered by the central bank pivot to QT---compounded by the fiscal insanity of the Trump-GOP debt binge.

In that context, the insouciant complacency in today's casino is all the more remarkable---and dangerous. The VIX index average during 2017 came in at 11.1. That is the lowest reading ever - by more than one and a half points - since the VIX inception in 1986. By way of comparison, the daily average for all years since then was over 20.

Likewise, the maximum level reached by the VIX in 2017 was 17.3. That's the lowest maximum level attained in any year since inception----and 60% lower than average.